Today is Presidents’ Day. According to a recent poll of employers conducted by SHRM, 34% of employers will be closed today. Whether you are closed on any holiday, here are 8 things you should know about holiday pay for your employees. All of these guidelines assume that your company lacks a collective bargaining agreement.

1. Do you have to pay for holidays? You are not required to pay non-exempt employees for holidays. Paid holidays is a discretionary benefit left entirely up to you. Exempt employees present a different challenge. The Fair Labor Standards Act does not permit employers to dock the salary of an exempt employee for holidays. You can make a holiday unpaid for exempt employees, but it will jeopardize their exempt status, at least for that week.

2. What happens if holiday falls on an employee’s regularly scheduled day off, or when the business is closed? While not required, many employers give an employee the option of taking off another day if a holiday falls on an employee’s regular day off. This often happens when employees work compressed schedules (four 10-hour days as compared to five 8-hour days). Similarly, many employers observe a holiday on the preceding Friday or the following Monday when a holiday falls on a Saturday or Sunday when the employer is not ordinarily open.

3. If we choose to pay non-exempt employees for holidays, can we require that they serve some introductory period to qualify? It is entirely up to your company’s policy whether non-exempt employees qualify for holiday pay immediately upon hire, or after serving some introductory period. Similarly, an employer can choose only to provide holiday pay to full-time employees, but not part-time or temporary employees.

4. Can we require employees to work on holidays? Because holiday closings are a discretionary benefit, you can require that employees work on a holiday. In fact, the operational needs of some businesses will require that some employees work on holidays (hospitals, for example).

5. Can we place conditions on the receipt of holiday pay? Yes. For example, some employers are concerned that employees will combine a paid holiday with other paid time off to create extended vacations. To guard again this situation, some companies require employees to work the day before and after a paid holiday to be eligible to receive holiday pay.

6. How do paid holidays interact with the overtime rules for non-exempt employees? If an employer provides paid holidays, it does not have to count the paid hours as hours worked for purposes of determining whether an employee is entitled to overtime compensation. Also, an employer does not have to pay any overtime or other premium rates for holidays (although some choose to do so).

7. Do you have to provide holiday pay for employees on FMLA leave? You have to treat FMLA leaves of absence the same as other non-FMLA leaves. Thus, you only have to pay an employee for holidays during an unpaid FMLA leave if you have a policy of providing holiday pay for employees on other types of unpaid leaves. Similarly, if an employee reduces his or her work schedule for intermittent FMLA leave, you may proportionately reduce any holiday pay (as long as you treat other non-FMLA leaves the same).

8. If an employee takes a day off as a religious accommodation, does it have to be paid? An employer must reasonably accommodate an employee whose sincerely held religious belief, practice, or observance conflicts with a work requirement, unless doing so would pose an undue hardship. One example of a reasonable accommodation is unpaid time off for a religious holiday or observance. Another is allowing an employee to use a vacation day for the observance.

Here comes the disclaimer. The laws of your state might be different. If you are considering adopting or changing a holiday pay policy in your organization, or have questions about how your employees are being paid for holidays and other days off, it is wise to consult with counsel.

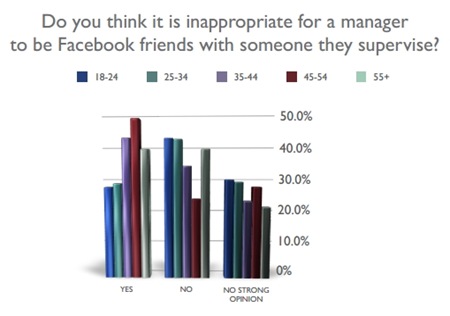

Only 28% of employees ages 18-34 believe it is inappropriate to friend their supervisor on Facebook. The number rises to nearly 50% for those ages 45 and up.

Only 28% of employees ages 18-34 believe it is inappropriate to friend their supervisor on Facebook. The number rises to nearly 50% for those ages 45 and up. How often does this scenario play out in your organization? An employee tells a supervisor that he’s sick and needs to take FMLA leave. The supervisor refers the issue to HR or management. Paralyzed out of fear that they will screw up an FMLA process that they really doesn’t understand, they approve the FMLA leave with no other questions asked.

How often does this scenario play out in your organization? An employee tells a supervisor that he’s sick and needs to take FMLA leave. The supervisor refers the issue to HR or management. Paralyzed out of fear that they will screw up an FMLA process that they really doesn’t understand, they approve the FMLA leave with no other questions asked.

According to

According to